Table of Contents

- Introduction

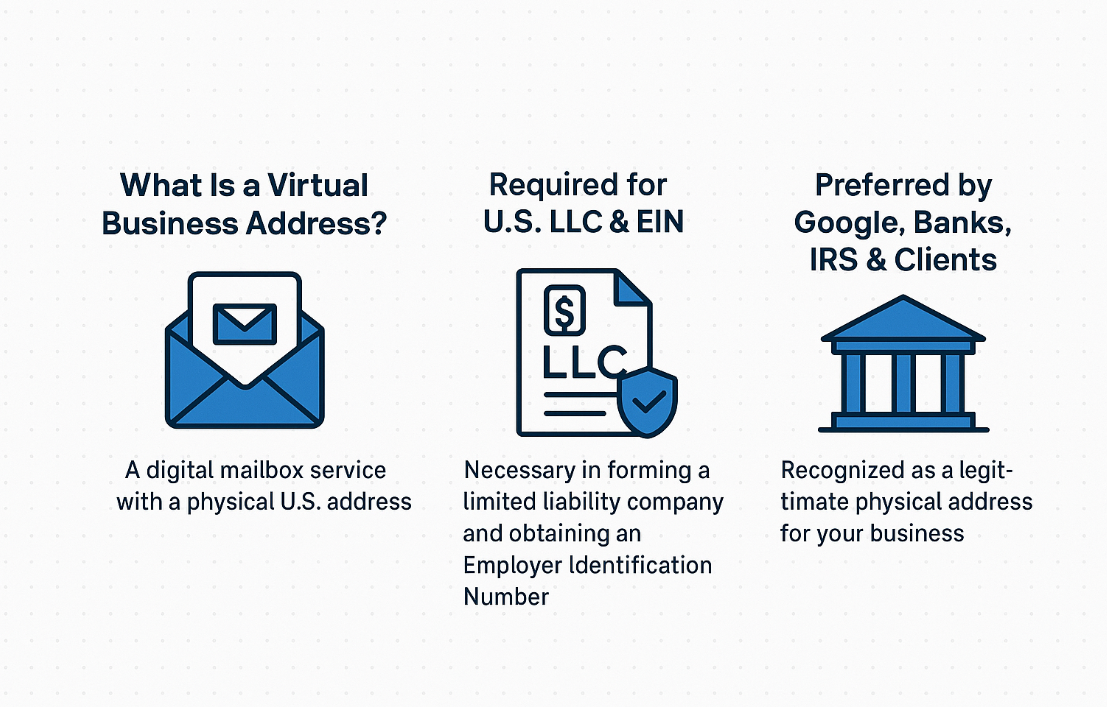

- What Is a Virtual Mailbox or Virtual Business Address?

- Why It’s Mandatory for U.S. LLC Formation and EIN Registration

- The Risks of Using a Home or International Address

- Why U.S. Banks, IRS, Google, and Clients Prefer a Physical Business Address

- Final Thoughts

1. Introduction

In today’s digital-first economy, running a business from anywhere in the world is more feasible than ever. However, when it comes to legal formalities, branding, and credibility—location still matters. Whether you’re a solo entrepreneur, international founder, remote freelancer, or launching a U.S. LLC, one thing is non-negotiable: a virtual business address.

It’s not just a convenient tool—it’s a critical foundation for building legitimacy, passing compliance checks, and protecting your privacy.

2. What Is a Virtual Mailbox or Virtual Business Address?

A virtual business address is a real street address—often located in a commercial building—offered by a third-party service. Unlike a P.O. Box, which is limited in use, a virtual address accepts official mail and packages on your behalf and scans them for easy digital access.

These services are often paired with a virtual mailbox—a secure, cloud-based portal where you can view, manage, forward, or even shred your incoming mail without physically being there.

In simple terms: you get a professional, physical U.S. mailing address without the overhead cost of an actual office.

3. Why It’s Mandatory for U.S. LLC Formation and EIN Registration

When forming an LLC in the United States or applying for an Employer Identification Number (EIN), you’ll be asked for your principal business address. This cannot be a P.O. Box—and if you’re an international founder, it cannot be a non-U.S. address either.

A virtual business address fulfills these mandatory requirements:

- It provides a U.S. street address for your LLC registration.

- It qualifies as a valid physical address for receiving EIN correspondence from the IRS.

- It helps you establish your “nexus” (legal presence) in the U.S.

Without it, your application may be delayed, flagged for review, or outright rejected.

4. The Risks of Using a Home or International Address

If you’re thinking about using your personal address (especially if it’s outside the U.S.) to register your business, here are a few risks you’re exposing yourself to:

- Privacy Breach: Your home address becomes publicly visible on government and business directories. This opens the door to spam, junk mail, and even unsolicited visits.

- Compliance Red Flags: Using a non-U.S. address for a U.S. entity often raises red flags for the IRS, banks, and vendors.

- Mail Delivery Issues: Delays or lost documents can cause major disruptions—especially when waiting on tax forms, legal notices, or checks.

- Rejection of Business Registration: States like Delaware, Wyoming, and New York require a U.S. business address. Using anything else can lead to application denials.

5. Why U.S. Banks, IRS, Google, and Clients Prefer a Physical Business Address

A virtual business address isn’t just about getting mail—it’s about building trust and legitimacy in the eyes of institutions and customers alike.

- Google Business Profile: Want to rank locally on Google or appear in Google Maps? A physical address is essential—P.O. Boxes or non-U.S. addresses won’t work.

- Banks: U.S. banks require a physical business address for opening accounts, performing KYC (Know Your Customer) checks, and sending debit cards or checks.

- IRS: For tax filings and EIN-related communications, the IRS mandates a valid U.S. street address.

- Clients and Vendors: A polished U.S. address makes your business look credible and operational—especially when dealing with corporate clients or suppliers who vet legitimacy.

6. Final Thoughts

A virtual business address is more than a formality—it’s a shield, a strategy, and a smart investment. It protects your privacy, ensures compliance, and builds your business credibility from day one. Whether you’re forming an LLC, applying for an EIN, setting up a Google Business profile, or simply trying to appear professional, a virtual business address should be one of your very first decisions.

In an age where everything is going remote, having a reliable U.S. business address keeps your operations grounded—legally, professionally, and practically.

FAQs

Q1. Can I use a virtual address as my registered agent address?

Some services offer both virtual business addresses and registered agent services, but they are usually treated separately. Always check if the provider offers both and confirm compliance with your chosen state.

Q2. Is a virtual mailbox legal for IRS communications?

Yes. As long as the virtual mailbox is tied to a real U.S. street address (not a P.O. Box), it can be used for IRS correspondence, including EIN approval letters.

Q3. What if I live outside the U.S.?

A virtual business address is ideal for international founders. It enables you to form a U.S. LLC, open a U.S. bank account, and appear locally credible—all without having to set foot in the United States.

Q4. How much does a virtual business address cost?

Costs typically range from $10 to $50 per month, depending on features like mail forwarding, scanning, or additional locations. Some premium addresses in commercial hubs may cost more.